Long-Term Wealth Production Through Real Estate: A Smart Investment Technique

Purchasing realty is among the most efficient methods to develop long-lasting riches. Whether through rental income, building gratitude, or portfolio diversification, real estate offers economic security and lasting growth. With the best technique, investors can take full advantage of returns and produce generational wealth.

Why Real Estate is Trick to Long-Term Wide Range Development

Stable Cash Flow-- Rental homes offer a consistent revenue stream, covering expenditures and producing profit.

Appreciation With Time-- Realty values often tend to climb, enabling investors to construct equity and boost net worth.

Tax Benefits-- Reductions on home loan interest, devaluation, and operating expenses aid take full advantage of profits.

Utilize Opportunities-- Utilizing funding choices, investors can get residential or commercial properties with a fraction of the complete price, boosting potential returns.

Rising cost of living Hedge-- As home worths and rental revenue surge with inflation, property assists shield against the decreasing value of money.

Ideal Realty Financial Investment Techniques for Long-Term Wide Range

1. Buy-and-Hold Strategy

Financiers acquisition homes and hold them long-term, taking advantage of both rental revenue https://greenspringscapitalgroup.com/available-properties/ and home admiration. This technique is suitable for those looking for passive income and monetary protection.

2. Rental Characteristics

Having household or commercial rental homes creates steady cash flow while enabling long-lasting https://greenspringscapitalgroup.com resources admiration.

3. Real Estate Investment Trusts (REITs).

For those who like a hands-off strategy, REITs offer a way to invest in realty without straight handling homes.

4. House Hacking.

Living in a multi-unit residential or commercial property while renting out the other units helps balance out living expenses https://greenspringscapitalgroup.com/available-properties/ and develop equity gradually.

5. Fix-and-Flip Method.

Refurbishing and re-selling residential properties at a greater cost can produce quick revenues, however it requires market knowledge and renovation know-how.

Secret Aspects to Think About Before Investing.

Market Research-- Assess building worths, rental need, and economic trends in your target location.

Funding Options-- Check out mortgage rates, loan terms, and financial investment collaborations to optimize take advantage of.

Residential Or Commercial Property Management-- Determine whether to self-manage or work with a expert residential or commercial property management business.

Risk Monitoring-- Expand your investments and have a backup prepare for market fluctuations.

Property is a tried and tested strategy for long-lasting wealth production. By leveraging smart financial investment methods, understanding market fads, and keeping a varied portfolio, investors can build economic safety and achieve long-term success. Whether you're beginning with a single rental property or increasing into business investments, property remains among the most powerful devices for wealth buildup.

Ashley Johnson Then & Now!

Ashley Johnson Then & Now! Katie Holmes Then & Now!

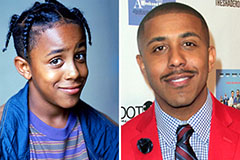

Katie Holmes Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Loni Anderson Then & Now!

Loni Anderson Then & Now! Shannon Elizabeth Then & Now!

Shannon Elizabeth Then & Now!